The LifeScore Labs difference

Predictive solutions

LifeScore Med360

A "game changer" that automates underwriting with lab data, LifeScore Med360SM outperformed traditional underwriting.

LifeScore EHD360

Fast and fluidless underwriting, LifeScore EHD360SM is powered by data from electronic health records.

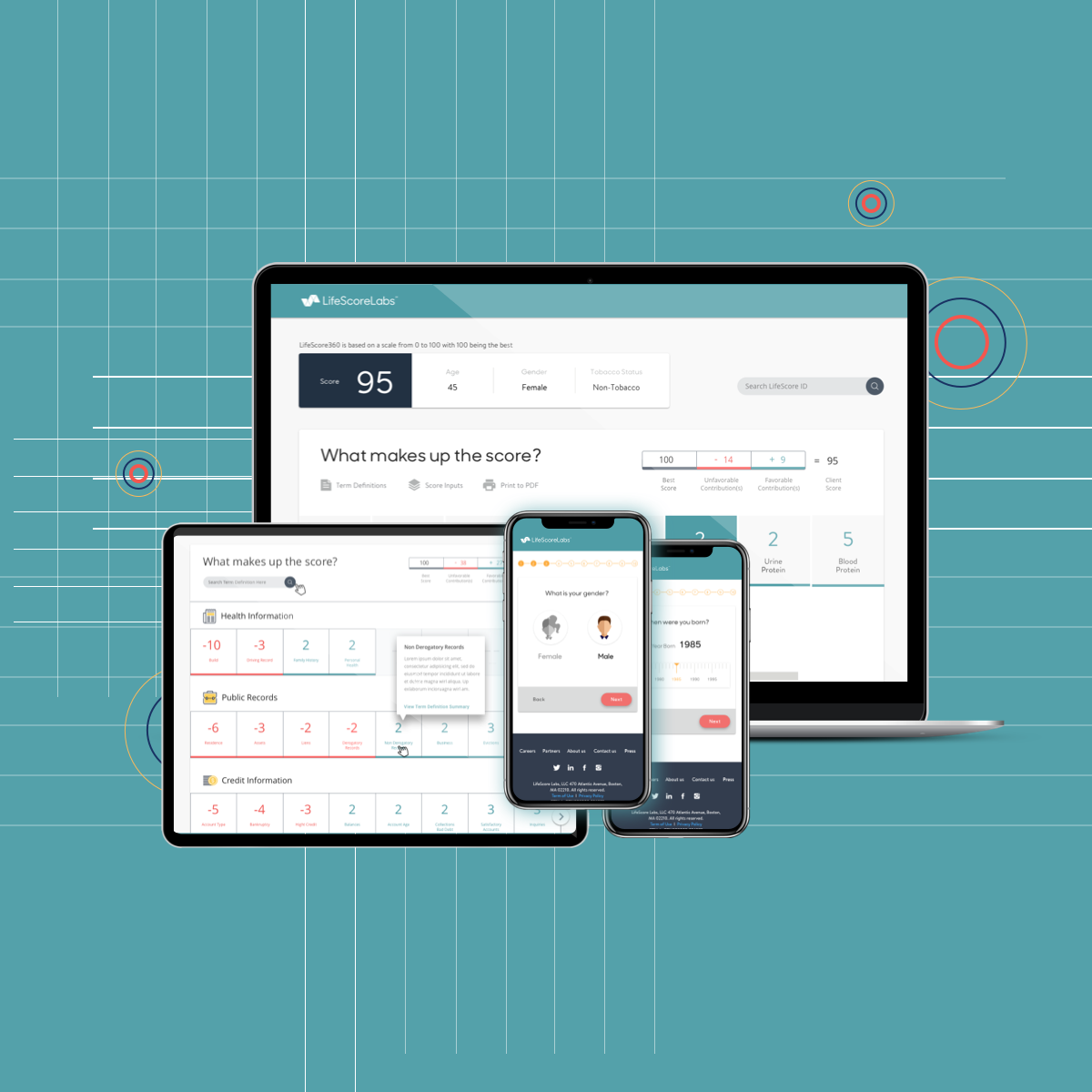

MyLifeScore

Our simplified web application demonstrates how our predictive models assess risk. Get started with 10 simple questions.

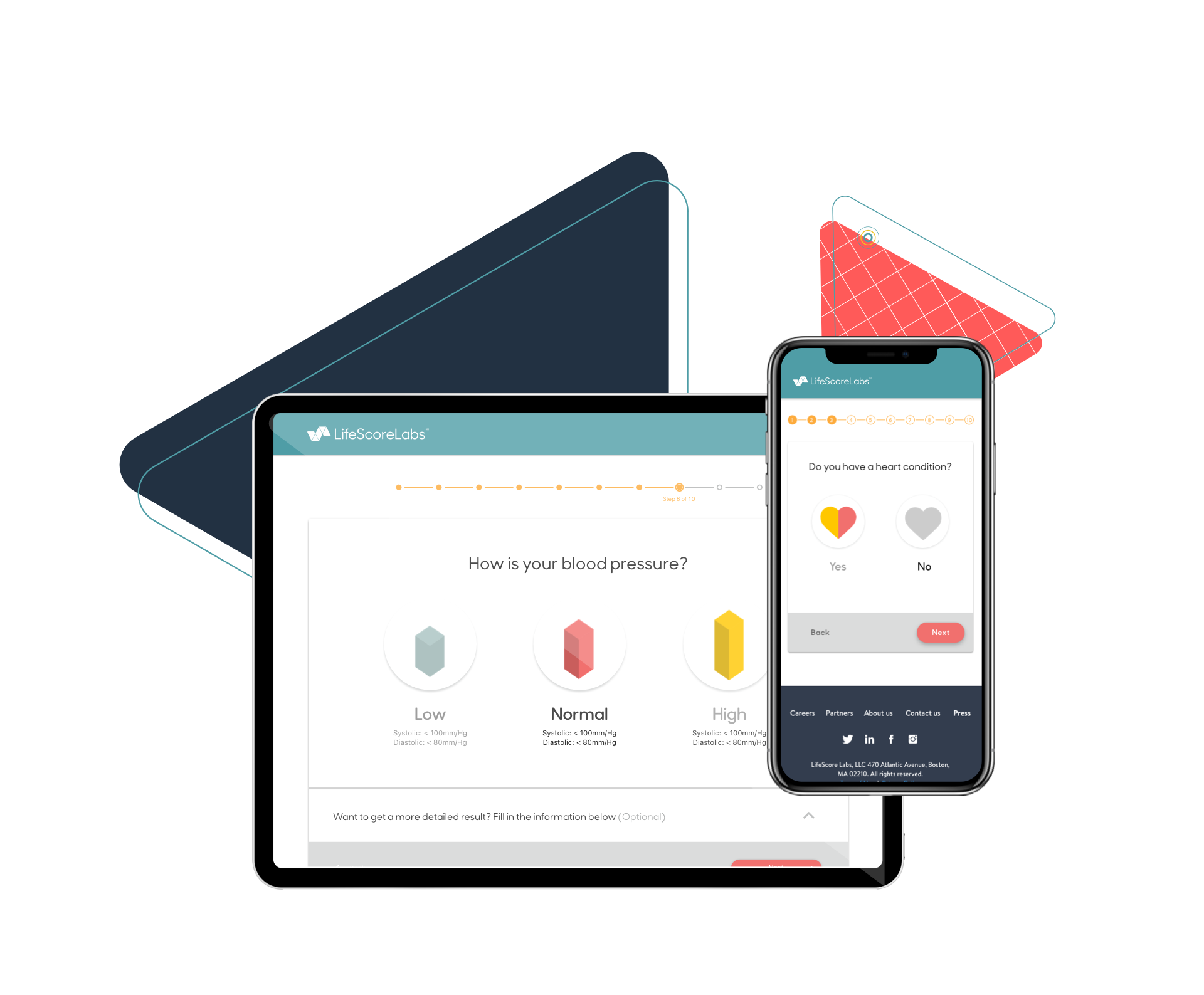

LifeScore PRISM

Identify and fine-tune risk assessment for some of the most common medical conditions.

What they're saying

"Swiss Re is committed to being at the forefront of improving the customer experience and closing the life insurance protection gap. We were therefore delighted that MassMutual asked us to partner together on LifeScore Med360, which is clearly a major evolution for life insurance underwriting and the consumer. We are excited to help other carriers unlock the combined power of risk selection and automation that LifeScore Med360 and Magnum can provide."

Neil Sprackling

President Swiss Re U.S. Life & Health

Which predictive model is best for you?

Our solutions can help you automate risk assessment, expand your fluidless underwriting or leverage some of the latest data sources in your underwriting