underwriting fueled by electronic health record data

LifeScore EHD360

For fluidless risk assessment, LifeScore EHD360 uses data in electronic health records to analyze risk and deliver a superior customer experience.

Accelerate underwriting with LifeScore EHD360

LifeScore EHD360 is a sophisticated predictive model that assesses mortality risk using existing clinical lab data within an electronic health record (EHR) along with medical and family history from the application. No medical exam is required.

Benefits

A fluidless customer experience

LifeScore EHD360’s fluidless, data-driven risk assessments help you meet consumer demand for a fast, non-invasive application process.

Realize the potential of EHR

LifeScore EHD360 makes it easy to harness EHR information by calculating a single mortality risk score for each applicant using:

- Existing clinical lab results from EHRs

- Customer medical interview/Application Part II

- Motor vehicle records

Seamless integration

Our API makes it easy to integrate into your current underwriting workflow, system and processes. Setting it up is as fast as the results it delivers.

Resources

The difference is the data

The data used to build, train and test predictive models makes all the difference.

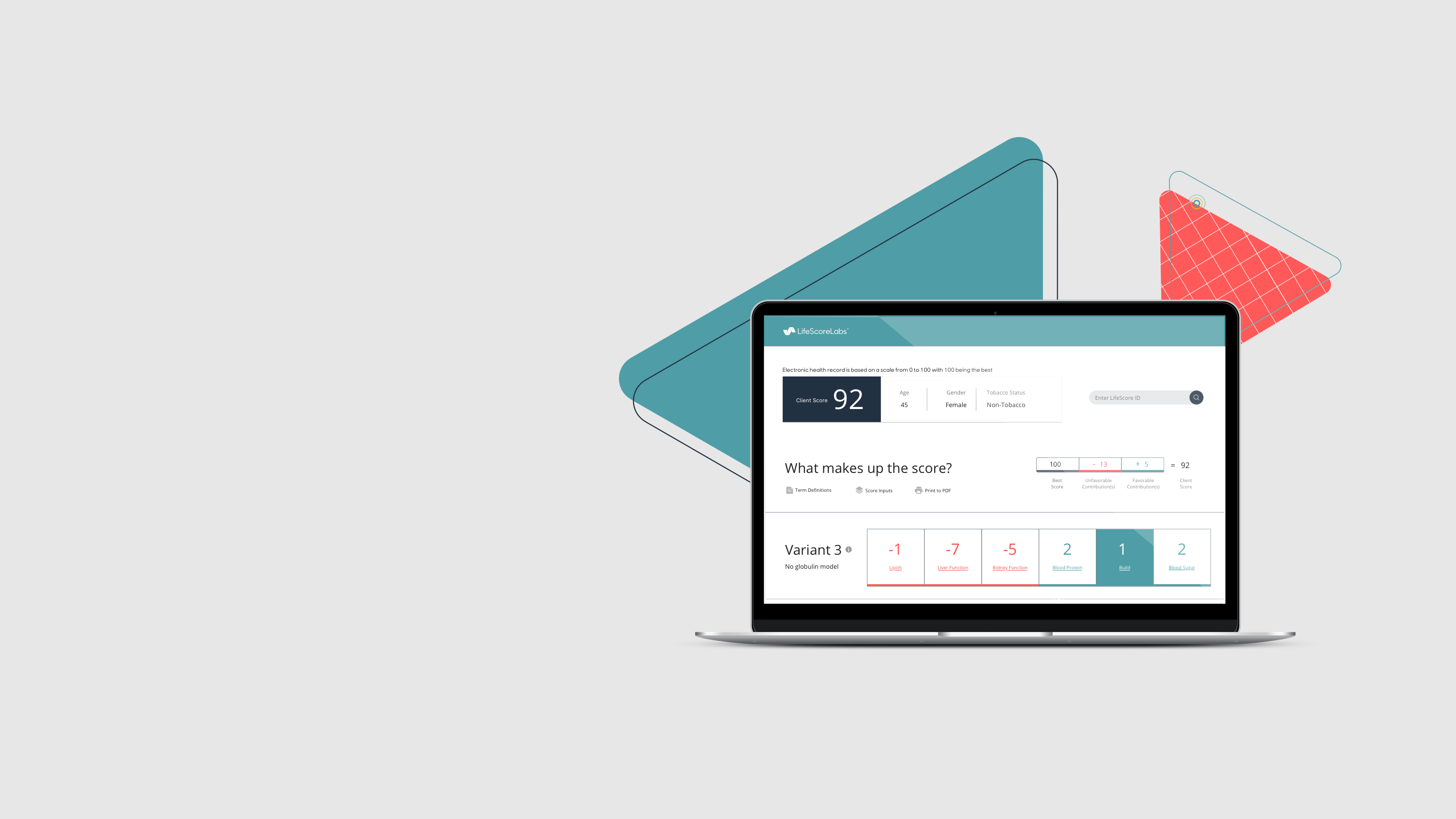

Sample Score Report

The sample Score Report is a transparent, explainable view into a predictive model's results.