assess risk without a medical exam

LifeScore Fluidless

Predictive risk assessment to accelerate and grow fluidless underwriting.

Identify applicants to accelerate

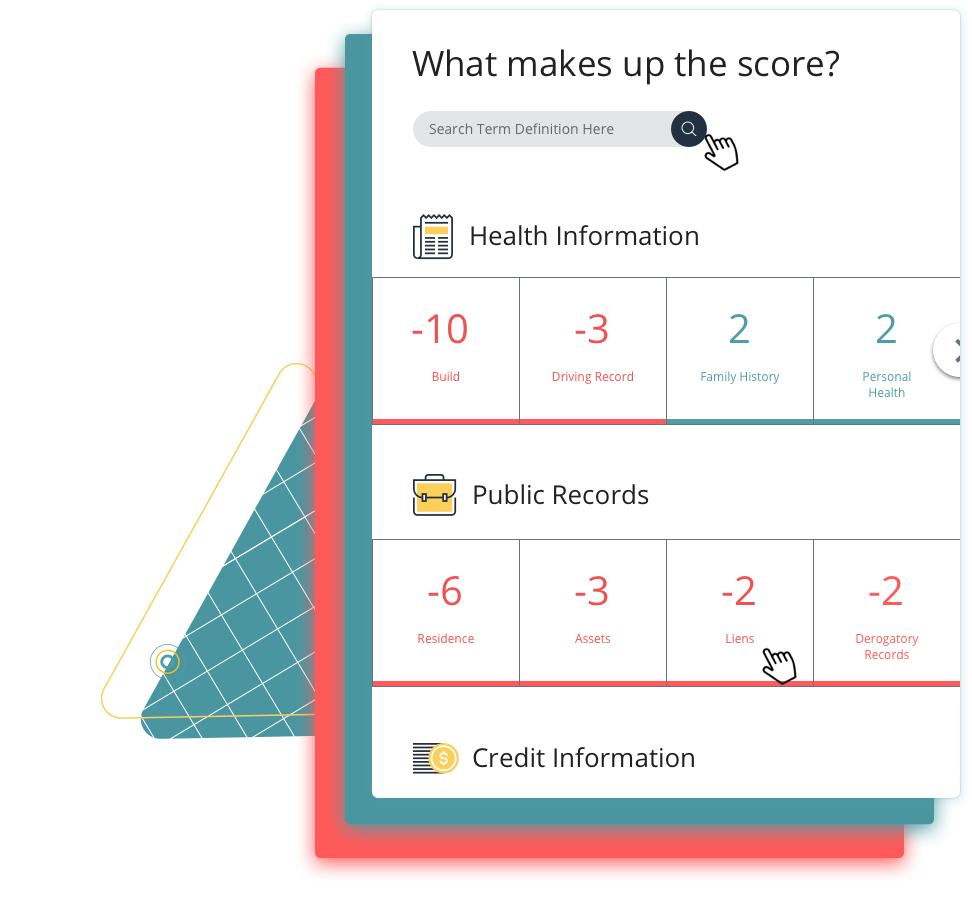

LifeScore Fluidless is an accelerated model that computes a single risk score from select credit, public, and self-reported medical information so you can quickly identify applicants for fluidless underwriting.

Benefits

Make faster underwriting decisions

Because LifeScore Fluidless is powered by instantly available data, not time-consuming and invasive medical exams, underwriters can assess mortality risk in seconds, not weeks.

Manage underwriting costs

Expanding no-touch or fluidless underwriting programs has a direct impact to your bottom line. It enables you to:

- Reduce underwriting time

- Reduce underwriting costs

- Reduce time-to-offer

- Increase acceptance rates

Improve the customer experience

Deliver a completely digital underwriting experience. Data drives underwriting, not invasive labs, busy doctor schedules and long wait times.

Resources

Sample Score Report

The sample Score Report is a transparent, explainable view into a predictive model's results.

The difference is the data

The data used to build, train and test predictive models makes all the difference.