The difference is the data

Our predictive models help the life insurance industry accelerate and automate underwriting.

LifeScore Labs predictive models were built, trained and tested on one of the industry’s most expansive data sets. The larger the data set, the more accurate and consistent the predictive results. Models trained on large data sets uncover patterns that would otherwise be impossible to find.

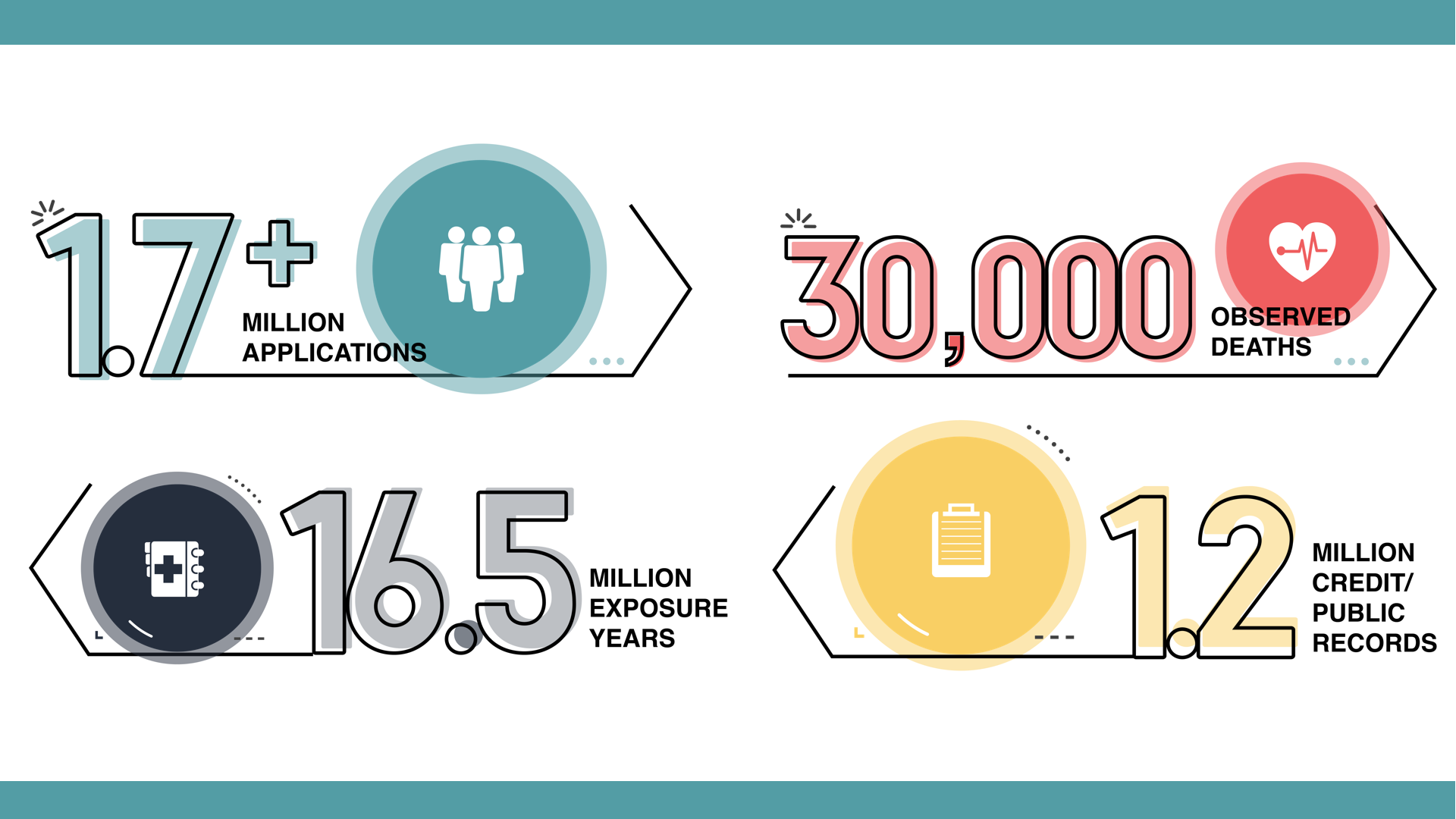

The data set

1.7+ million life insurance applications collected over 20 years

16.5 million exposure years

30,000 observed deaths over 23 years

An early investment in data

LifeScore Labs’ models are created from one of the earliest investments in data — an investment that’s transformed risk assessment and life underwriting by leveraging: